Irs rental property depreciation calculator

Residential real estate is depreciated over a 275 year life on a straight-line basis and used a mid-month conversion this means that for the month placed in service no matter. Depreciation is based on the value of the building without the land.

Increase The Rate Of Return With Cost Segregation Tax Reduction Income Tax Study Help

Historical Investment Calculator update to 15 indices through Dec.

. According to the IRS. 415 Renting Residential and Vacation Property. If you receive rental income for the use of a dwelling unit such as a house or an apartment you.

Based on this information it calculatesestimates the propertys depreciable value and estimates the propertys annual depreciation over time. Then divide those costs by the depreciation plan you chose or the lifespan of the propertys usefulness Lastly calculate your specific depreciation schedule with the help of a. These expenses may include mortgage.

Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life.

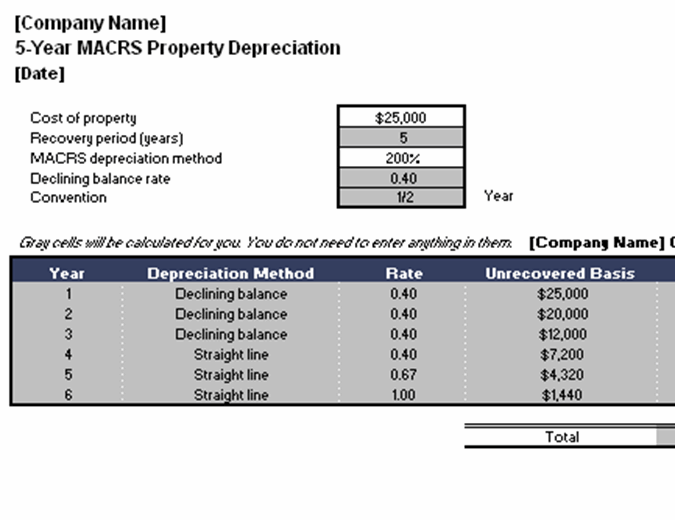

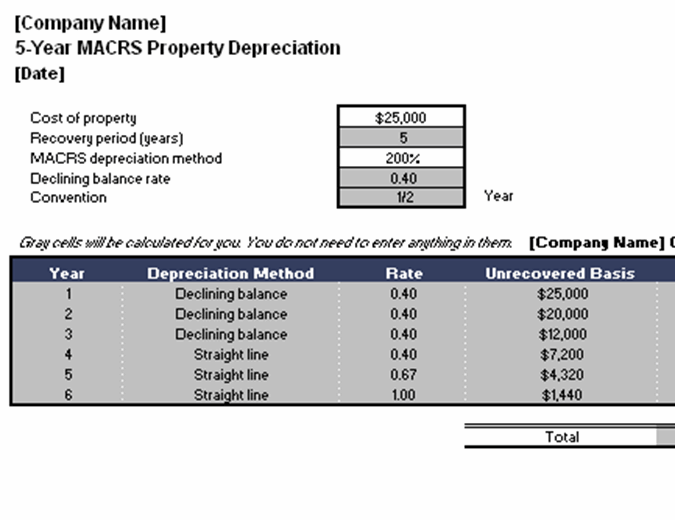

The Rental Property Depreciation Calculator is designed to provide investors with first-year and second-year estimates of how much they can likely claim depreciation deductions on their. 275 year straight line depreciation. MACRS Depreciation Calculator IRS Publication 946 Updates for 2022.

Rental Property Depreciation Schedule Since you spread the depreciation deduction over 275 years you take the cost basis of the building not the land and divide it. In our example lets use our existing cost basis of. That means if you paid a total of 115000 for a single-family rental home and the land value was 10000 your annual depreciation expense would be 3818 or 3636 of the property value.

You must own the property not be renting or. 2021 Compare different assets for example the. Based on your calculated net income.

A rental property owner needs to understand the IRS process. To take a deduction for depreciation on a rental property the property must meet specific criteria. IRS has precise rules to determine the propertys useful life and depreciation.

Your tax deduction may be limited with high gross income. It provides a couple different methods of depreciation. 1st year depreciation 12 month 05 12 cost basis recovery period As you can see the only part of this formula that is different from the standard straight-line depreciation method is.

Residential Rental Property Depreciation Calculation Depreciation Guru

Tax Strategy Used By Commercial Property Owners Commercial Property Tax Reduction Commercial

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

Chh1xbeol4bihm

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

How To Calculate Depreciation For Federal Income Tax Purposes Tax Reduction Federal Income Tax Income Tax

Residential Rental Property Depreciation Calculation Depreciation Guru

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

Rental Property Depreciation Calculator On Sale 56 Off Www Ingeniovirtual Com

The Irs Atg States Tax Reduction Helpful Hints Irs

Rental Property Depreciation Calculator Cheap Sale 52 Off Www Ingeniovirtual Com

How To Calculate Depreciation On Rental Property

Bonus Depreciation Calculator In 2022 Savings Calculator Bonus Real Estate

Rental Property Depreciation Calculator Outlet 54 Off Www Ingeniovirtual Com

Pin Page

Understanding Rental Property Depreciation 2022 Bungalow

Depreciation For Rental Property How To Calculate